Powered by AI, Built for Smarter Investing

🔍 1. Market Data

- Live prices & volume

- Earnings & updates

📊 2. Multi-scale Analytics

- Technical analysis

- AI-driven predictive analysis

⭐ 3. Ratings Engine

- Trend ratings

- Price ratings

- Entry ratings

🚀 4. PickWiseAI Dashboard

- Top-rated stocks

- Live filters

- Entry price targets

⏱️ Faster decisions with live data

🎯 Smarter trades with buy signals & entry recommendations

🛡️ Lower risk with transparent signals

Key Metrics Explained

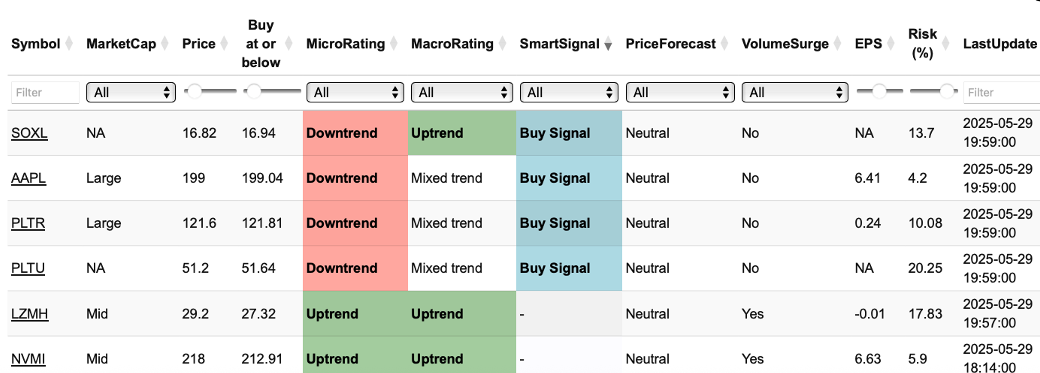

| Column | Description |

|---|---|

| Symbol | The stock or ETF ticker symbol (clickable for details on Yahoo Finance). |

| MarketCap | Market Capitalization. Total value of a company’s outstanding shares of stock. Large Cap ($10 billion and above), Mid Cap ($2 billion to $10 billion), Small Cap ($300 million to $2 billion), and Micro Cap (Under $300 million). Risk and volatility increases with small cap stocks. |

| Fundamental Strength Index | Fundamental Strength Index (FSI) is a proprietary score developed by PickWiseAI that evaluates a stock’s core financial health (rated as Good, Moderate, or Poor) |

| Price | Price at the time of the last update |

| Entry Conditions | Uses our proprietary composite score based on trends, volume, and price levels to assign a rating for entry: excellent (great time to buy), good, moderate, hold (price is high) |

| Health Rating | Uses our proprietary composite score based on trends to assign weak, moderate, and good health ratings |

| Micro Trend Rating | Uses our proprietary composite score to assign intraday trend rating |

| Macro Trend Rating | Uses our proprietary composite score to assign long-term trend rating using the latest and historical data |

| Buy at or below | Recommended entry price using the intraday buy signals. |

| Entry Range | Price range where intraday technical entry signals were triggered. |

| Support | Price zone where a stock or asset tends to stop falling and bounce back up |

| Resistance | Price zone where a stock or asset tends to stop rising and reverse downward |

| Forecast Rating | AI-estimated near-term price target based on predictive analytics. This feature is only available for our Pro plan subscribers. |

| Volume Surge | Indicates whether the trading volume is higher compared to recent averages. |

| EPS | Earnings Per Share (TTM) – the earnings per share of a company calculated over the trailing twelve months. |

| Risk (%) | % Risk represents the potential loss in value of a stock over a 1-day holding period, with 95% confidence. For example, if a stock has a Risk (%) of 3%, it means there is a 95% chance the stock will not lose more than 3% in a single day but a 5% chance that losses could exceed 3%. This feature is only available for our Pro plan subscribers. |

| LastUpdate | Time when the row was last refreshed with the latest data. |

How to Use PickWiseAI

- Use the filters and sliders to explore top-rated stocks and ETFs.

- Use MarketCap to filter by market capitalization (large cap, mid cap, small cap).

- Use Fundamental Strength Index (FSI) to filter by company’s finacial health (Good (✓), Moderate (⚠️),Pook (✘) based on earnings, valuation, profitability, cash flow, and debt levels.

- Use Health Rating to filter by stock’s trend quality: Excellent or Good (✓), Moderate (⚠). Health Rating evaluates a stock’s trend by combining a variety of technical indicators. Stocks with poor health are excluded.

- Sort by VolumeSurge + MacroRating + MicroRating to evaluate momentum & acitivity

- Use Entry conditions + MicroRating + Buy signal range to evaluate ideal entry points.

- Use PriceForecast to estimate short-term price movement (e.g., Higher, Lower, Neutral).

- Use Risk (%) to reduce the risk of losses and avoid highly volatile stocks.